We introduce you to customer profitability analysis and how to make the necessary calculations in the contact centre.

What Is Customer Profitability?

Customer profitability is the total profit generated by a customer, often in a single transaction, but ideally tracked over the course of time that they do business with you.

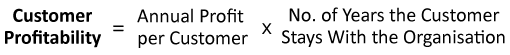

With this definition in mind, you can use the following formula to calculate customer profitability:

However, getting the data and the business intelligence to put this formula into practice can be very challenging – so what is the value in calculating the metric?

Why Calculate Customer Profitability?

It is good to understand the profitability profile of customers as you may wish to have different customer attraction, retention, upsell and even exit strategies depending on their profitability.

It is not unusual for companies to route higher profitability customers to shorter queues or to more experienced advisors. But primarily the insight that customer profitability analysis gives you is hard data that enables you to improve the organization’s overall profitability.

As Dougie Cameron, COO at The Centre for the Moving Image and the Edinburgh International Film Festival, says: “The key benefit to customer profitability analysis is that you have data-backed information that will allow you to make decisions at the customer (or product) level to transform your overall profitability.”

So, how can we get started?

Step 1 – Understand Your Revenues and Costs

To understand customer profitability you need to understand the revenues and costs related to customers.

According to Dougie, “Revenue is normally relatively straightforward to extract from customer billings. Costs on the other hand can more challenging and require a greater degree of judgement.”

Dougie adds: “The level of granularity that you look at will be influenced by a few things – the type of customer, the quality of customer level data that you hold, your capacity to process and action the insight.”

The level of granularity that you look at will be influenced by a few things – the type of customer, the quality of customer-level data that you hold, your capacity to process and action the insight.

This is fairly straightforward if you work in a B2B environment, as you can look at the direct costs and revenues of individual customers.

In a B2C business, revenue identification remains straightforward but the allocation of costs to individual customers is more difficult. This involves making some high-level assumptions about customer behaviour to get a reasonable approximation of cost.

Step 2 – Split Your Customer Base Into Cohorts

For organizations in a consumer environment, it is impractical to work out the costs and revenues of each individual customer. So, we need to find ways to simplify the process.

It is usually more efficient to look at cohorts of customers with similar behaviours and characteristics, for example similar packages or customers with similar churn profiles.

As Dougie says: “It is usually more efficient to look at cohorts of customers with similar behaviours and characteristics, for example similar packages or customers with similar churn profiles.”

The number of cohorts that you create will depend on the amount of detail that you are willing to go to, as you may want to consider factors such as channel preference and propensity to contact.

For each of these cohorts there will be different costs from other areas of the business also, so be sure that you are able to access financial reports and other necessary documents from other departments before you begin the process.

But let’s pretend that we have all the necessary information: how can we then go about calculating customer profitability for each cohort?

Step 3 – Calculate the Profitability of Each Cohort

For each cohort you want to create typical “customer profile” that accurately assumes the revenues and costs of a customer that fits within that grouping.

Dougie Cameron

Dougie says: “Identify for each individual customer or cohort the revenue profile that is unique to that customer, including all their products, pricing and discounts, and then deduct the relevant direct costs. This includes retention costs, contact costs, direct product costs, etc.”

“One categorization of costs that can be really useful as an actionable tool is the cost of quality. This involves customer support costs related to poor product or service.”

How you categorize costs will depend on the level of detail that you’re willing to go to. But by deducting the annual revenues from the annual costs for each cohort, you can find your annual profit for a typical customer that fits into each cohort.

All that is left to do then is to multiply annual profit by the number of years the customer is likely to stay with you. To do this, you will need to have an understanding of average customer tenure and churn rate for each individual cohort.

Measure Product Profitability as Well

While customer profitability analysis can provide you with information to boost your revenues, Dougie Cameron also recommends calculating product profitability.

Dougie says: “The combination of product profitability and customer profitability is particularly powerful as you can identify customers, products, or customer/product combinations that create a drag on your overall profitability.”

The combination of product profitability and customer profitability is particularly powerful as you can identify customers, products, or customer/product combinations that create a drag on your overall profitability.

With this information you can ensure you are promoting to customer types that bring the most value to your organization, either through immediate value or through prolonged loyalty.

Just remember, the aim is to use your analysis to create effective strategies for each cohort…

The Outcome of Customer Profitability Analysis

The output of customer profitability analysis is that you will be able to categorize customers by profitability and identify a strategy for each category, effectively allowing a portfolio approach to customer marketing and investment.

A strategy for customers with high lifetime value may be to invest heavily in rewarding loyalty, while you may withdraw all investment from loss-making customers.

This is according to Dougie, who suggests that a “strategy for customers with high lifetime value may be to invest heavily in rewarding loyalty, while you may withdraw all investment from loss-making customers.”

“Within this, it is important to understand the nuance – two customers with the same profitability may have different cost and revenue structures – your strategy to improve profitability may be to reduce cost or increase price or both depending on the insight. The more granular the insight that you develop, the more you can tailor your approach to customers and understand the likely outcomes.”

These strategies will start at a high-level strategy but ultimately should evolve to the frontline helping guide advisors in their day-to-day customer interactions, as discussed below with a little insight from Ritz-Carlton.

Train Advisors to Identify Customer Profitability

We can use customer profitability analysis to educate and train advisors to understand which customers are the most profitable, so they can adapt their service approach accordingly.

How can we do this? One idea could be to adopt a model like Ritz-Carton used, as reported in the book “The New Gold Standard” by Joseph Michelli.

The book explains how Ritz-Carton gives advisors $2,000 every day to help solve customer problems without asking a manager. This is after training them on when is best to use this money and the most valuable customers to spend it on.

Treating all customers equally is not necessarily the best course of action when maximizing profits.

While you may think $2,000 is a bit much, your customer profitability analysis will highlight the types of customers which are good to spend more money on. Treating all customers equally is not necessarily the best course of action when maximizing profits.

As Dougie says: “Most contact centres don’t train advisors to use their judgement to look after customers based on their value.”

“While they’ll coach advisors to hit certain metrics, advisors will seldom look at a customer’s loyalty or high expenditure and reward them for that – it will only ever happen if the customer’s in danger of churning, and by then the opportunity to impress a customer has been lost.”

With this in mind, it can be great to take customer profitability into the heart of our culture, remembering that, while every customer is important, some are mission critical.

3 Pitfalls of Calculating Customer Profitability

Here are three key pitfalls to avoid when calculating customer profitability.

Don’t “boil the ocean” – Do not work out customer profitability at an individual level. By the time you gather all the necessary information to do so, all value in calculating that customer’s profitability will be lost.

Every customer is important, but not all are equal – Some customers spend more and some are more loyal, so don’t treat them as equal. Work out which are most profitable, across their customer lifespan, and make sure these customers receive the best possible service. Meanwhile, don’t lose sight that all customers are important and potential advocates of your business.

Don’t confuse customer profitability with customer lifetime value (CLV) – CLV is a much more common metric in the contact centre because it is easier to calculate. However, it does not take customer costs into consideration, and therefore the customer’s overall profitability.

To find out more about CLV, read our article: How to Calculate Customer Lifetime Value – The Formula

In Summary

Customer profitability is a tricky metric to calculate as you need buy-in from other departments within your business to track customer costs.

Then there is the issue of using the customer profitability equation presented in this article, as it is impractical to use it for every individual customer.

So larger consumer-facing businesses will likely have to split their customers into cohorts, creating annual revenue profiles for each and then deducting relevant annual costs to estimate an annual profit for customers within each group.

Then, all you need to do is estimate a churn rate for each cohort and then multiply the number of years customers within each cohort are likely to remain a customer by the annual profit projection.

It is then a good idea to measure product profitability, to help give you maximum insight into which service strategy you should apply to each cohort.

Just remember to avoid treating all customers as equals if you want to make the most out of your analysis and boost revenues. While it might be nice in principle, you want to be at your best when supporting loyal and valuable customers.

For more “How to Calculate” articles, read the following:

Author: Robyn Coppell

Published On: 29th Jul 2019 - Last modified: 28th Feb 2024

Read more about - Customer Service Strategy, Customer Management, Dougie Cameron, How to Calculate, Retention