Supporting vulnerable customers isn’t just about ticking a regulatory box, it’s about delivering genuine care in every conversation.

In today’s contact centres, advisors are increasingly encountering customers facing difficult life circumstances, from bereavement and illness to financial hardship. But vulnerability is complex and deeply personal, and labels can sometimes do more harm than good.

We take a look at how you can provide the best possible service to vulnerable customers in the contact centre that truly meets each customer’s needs.

Be Careful of the Vulnerable Customer Label

Before we go into how to best handle contacts from vulnerable customers, it’s first important to stress that vulnerability is a controversial label.

The vulnerable tag is one that we impose upon our customers and one that some vulnerable customer groups will challenge.

After all, a customer who doesn’t think of themselves as vulnerable may be a little embarrassed or even offended if they feel that they are being singled out.

With this in mind, it’s important to train advisors to always be respectful and caring when handling contacts from vulnerable customers, while also creating training objectives around this principle.

Read on to discover how to deal with vulnerable customers.

15 Ways to Deal With Vulnerable Customers

Let’s take a look at some tips and strategies you can give to advisors, so they can control the call, once they’ve identified a vulnerable caller.

1. Use the CARE Method

There are a number of warning signs that an advisor can pick up on to identify if the caller on the other end of the line is in fact vulnerable.

A simple thing that an advisor can do to help with this identification is to consider the following the four questions and whether or not they apply to the customer.

The questions come under the acronym CARE which stands for Comprehend, Assess, Retain, and Evaluate:

C – Comprehend

Is your customer able to follow and understand the discussion taking place?

A – Assess

Is your customer able to follow and understand the discussion taking place?

R – Retain

Does your customer appear able to retain the information you are giving them? / Can they recall details or are you having to repeat?

E – Evaluate

How well do they express, explain or communicate their decisions? / Is the dialogue genuinely two-way or are they simply agreeing with what you say?

Within the four questions above, there are a number of “prompts” that the customer may give.

Customer prompts that may show they are vulnerable:

- The customer asks unrelated questions and make irrelevant points

- The customer consistently repeats themselves

- The customer says “yes” in response to each of your questions, when it’s clear that they haven’t kept up with the conversation

- The customer doesn’t talk much and takes a long time to answer your questions

- The customer becomes distressed during the contact

- The customer sounds flustered, indicating that they may have an illness

- The customer says things like “My partner dealt with all these things for me”

These are examples of the things that advisors should listen carefully for. If they pick up on one of these “prompts” they need to think carefully about what to do next.

“Go back to the basics of the interaction and consider what the customer’s primary need from the interaction is.

If the customer is in a stressful situation or they are very upset, that might not be clear on the call and we need to think about how we can extract that information from them.

Then, think about what you need to do first and think about what reasonable adjustments you can make. Perhaps you need to communicate with them in a different way and listen to them for a bit longer to really understand what the information is that they require.” – Jacqui Workman, Owner and Managing Director of KMB

2. Use the BRUCE Acronym

BRUCE is another useful protocol to identify customers in vulnerable circumstances.

This can be utilized in cases where there are uncertainties regarding the customer’s capacity, and it aligns with the principles of the Mental Capacity Act 2005.

According to the act, an individual is deemed incapable of making a decision if they are unable to comprehend relevant information, retain and evaluate it as part of the decision-making process, or communicate their decision effectively.

The acronym BRUCE stands for Behaviours and Talk, Remembering, Understanding, Communicating and Evaluating:

B – Behaviours and Talk

Does the customer’s speech and behaviour offer any clues that suggest they may be vulnerable?

R – Remembering

Are there any indications that the customer struggles with remembering things?

U – Understanding

Do you notice any indications that the customer is having trouble comprehending the information you’re providing?

C – Communicating

Can the customer effectively express their thoughts, decisions, and any inquiries they may have?

E – Evaluating

Is the customer experiencing challenges in assessing all the provided information?

3. Follow the Five Steps of the TEXAS Drill

The Royal College of Psychiatrists and the Money Advice Trust have developed several tools aimed at guiding interactions with vulnerable clients, one of which is TEXAS.

TEXAS comprises five straightforward steps designed to facilitate discussions about vulnerability in a considerate, equitable, and legal manner.

If a customer discloses sensitive information (such as early-stage dementia or bereavement), you should follow the TEXAS Drill.

The acronym TEXAS stands for Thank, Explain, Explicit, Ask, and Signpost:

T – Thank the Customer

Express gratitude to the customer and confirm that their disclosure will enable you to handle their situation sensitively and appropriately.

E – Explain How the Information Will Be Used

Clarify how the provided information will be utilized to meet legal obligations regarding data usage (e.g., disclosing information only to relevant parties involved in processing their policy).

X – Explicit Consent to Gain Personal Information

Obtain explicit consent to retain and utilize this data, as required by law. Without consent, certain details, such as “customer has mild dementia,” cannot be recorded.

A – Ask Questions Respectfully

Pose up to three pivotal questions to gain deeper insights into the situation. These inquiries might include:

These could be

- How does your current situation impact your ability to manage your finances?

- In what ways does your situation affect your communication with us? (This may not be immediately evident, especially if the customer has profound hearing or vision impairment or is dealing with a terminal illness.)

- Do you have support in managing your finances, such as a family member, caregiver, or solicitor?

S – Signpost to Internal or External Support if Needed

Offer suitable internal or external support options as required. For instance:

- Guide them to a debt advice service if financial control is a concern.

- Suggest bereavement counseling if they’re coping with the loss of a loved one.

- Encourage reaching out to Samaritans (free phone 116 123) if feelings of despair or thoughts of suicide arise.

4. Ask the Customer About Their Communication Preferences

A vulnerable customer may only be using the phone because they think that is their only option. They might prefer speaking on email or live chat – particularly if they have a hearing impairment.

“For instance, everybody thinks that when someone is blind they may want their information in Braille but, in actuality, only 1% of blind people can read Braille. There are other ways, such as audio messaging, which a blind customer may prefer.” – Jacqui

Another question that an advisor should ask when speaking to a vulnerable customer is if there is a better time for a call-back.

After all, you may have had to share some bad information with them and they may want some time to process that and take the call when they’re in a calmer place.

5. Set Clear Expectations

Vulnerable customers may struggle to “keep up” with the conversation, so it’s best to outline all the information that will be required for the call up front.

From here on out, it’s important to direct the conversation and take ownership of the call, in case the customer begins to lose track.

Explain to the customer how long the call will be expected to last and make sure that all of the information shared is relevant and in the best interest of the customer.

6. Avoid Assumptions

We always advise caution when it comes to making assumptions of a customer’s issue, as you can easily jump into suggesting the wrong solution.

However, this is more important when it comes to handling contacts from vulnerable customers – take nothing for granted.

For example, can the customer hear what you’re saying? They may have a hearing impediment.

Also, consider if the person you are talking to has good eyesight. If they do not, they may be unable to read statement details, serial numbers and other information.

This is why it is great to be prepared to offer other materials, such as large-print PDFs, Braille or audio tools.

7. Visualise the Customer

Try to visualise the customer in your mind, so that you can relate to them better and home in their dominant needs first.

This tip was suggested by Jacqui Workman, who says: “Put the customer at the heart of your thinking. Train advisors to think of the customer as a close friend or family member, in a vulnerable circumstance, who needs something from you.”

8. Clearly Enunciate and Speak at a Relaxed Pace

When speaking to vulnerable customers it is important to be conscious of the tone of your voice. The key is to speak clearly and enunciate, but not to the extent where you end up shouting at them.

Stay at a relaxed pace to avoid bombarding the customer with too much information or rushing them into responding when they haven’t fully explained what they need.

For advice on how to improve tone, read our article: How to Utilize Tone of Voice in the Contact Centre

9. Clarify an Understanding After Each Key Point

Questions such as “Are you happy with everything that I’ve just said?” or “Is there anything that you’d like me to explain?” will help you gauge whether or not the customer is keeping pace with what you are saying.

Subtly asking the customer to explain their understanding, if you are not convinced that they are on the right track, will help to make this more obvious.

Just remember to be patient and give the customer all the time that they need to process instructions and explain their situation fully. Don’t interrupt them or show any signs of impatience.

10. Summarise the Call at the End of the Interaction

When closing the call, it is important that the vulnerable customer has understood all of the key call outcomes and the next steps that they need to take.

Ensure that the customer is not in an emotional state when they answer this question and consider whether the customer fully understands the consequences of the decision that they are making

However, how can you, as the advisor, guarantee that the customer has taken everything in?

When summarising the call, ask the customer if they are happy and have been able to follow everything that you’ve said. If they say “yes”, consider whether this is a genuine yes or just a submission.

Also, remember to ensure that the customer is not in an emotional state when they answer this question and consider whether the customer fully understands the consequences of the decision that they are making.

11. Create Fact Sheets Around Different Vulnerabilities

Ask people in your organisation looking to create case-specific training or fact sheets to help people research different conditions and understand a bit more about them before taking those calls.

If advisors know the basic challenges that people of all “mainstream” vulnerabilities have to go through, it increases their understanding of how to help the customer and perhaps their empathy levels too.

Contributed by: Brianna

12. Focus the Call on Customer Needs

We always ask what kind of support they need. Is it financial assistance, do they need a different communication method? Everything we do is guided by their needs.

The starting point is to set a clear agenda at the start of the call and set expectations, something along the lines of: “What I’d like to do today is ask you a few questions to understand a little bit more about your circumstances…”. This will help to open the conversation up.

13. Appoint Mental Health Champions

We always have a few mental health champions at our place of work as the well-being of the employees is just as important as the well-being of our customers.

When dealing with difficult information, don’t underestimate the value of having a go-to person to discuss difficult moments with.

Contributed by: Emma

Supporting the mental health of your staff is important and in our survey we found that there is a positive picture of various initiatives taking hold as the norm across many contact centres.

Nearly half of survey respondents (44%) said they had Mental Health First Aiders and posters for external services such as Samaritans (42.6%), whilst around a third said they had a wellbeing room on site (27.3%) and benefited from regular drop-in sessions (32.1%).

For more information on supporting your agents’ mental health, read our article: A Guide to Improving Mental Health In the Contact Centre

14. Create Links With Charities That Serve Vulnerable People

If you can arrange it, create links within your local community to care homes, day services, even local authorities, and allow staff time out to help them.

By doing so, you can help your team to make the “real world” connection to vulnerability that can only boost their customer service skills.

Also, think about becoming a Dementia Friendly organisation. You can find out how to do this by following the link: www.dementiafriends.org.uk

Contributed by: Steve

15. Discuss Advisor Care in the Contact Centre

Make time in team meetings, huddles and briefings to discuss difficult calls and share how you practise self-care at work.

In my contact centre, we often have very difficult conversations about sensitive topics, and having that time and space to discuss it openly and honestly helps our team to feel bonded and better prepared to handle those difficult conversations with people in vulnerable situations.

Contributed by: Mary

Make Sure You Have a Vulnerable Customer Policy

According to Jacqui Workman, the place to start in creating a plan to help deal with vulnerable customers is by creating a policy, making sure it is something that you can use, adapt and review.

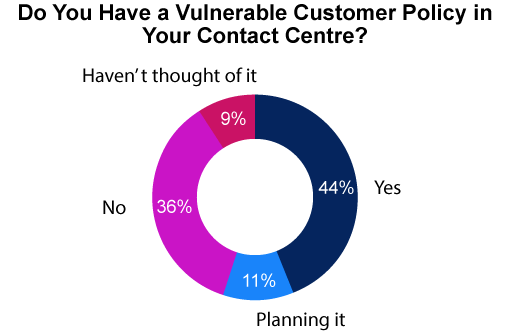

However, just 44% of organisations have a vulnerable customer policy in place, as highlighted in the chart.

These results are surprising, as Jacqui says: “Many organisations like to have an external policy, so people can understand what you’re going to do, as an organisation, when dealing with vulnerable customers. It is something that many families of vulnerable customers may like to see.”

When creating this policy it’s important to think about the procedures and technology that you already have in place and consider what reasonable adjustments you can make.

As Jacqui says: “These might be very small things like communicating with a person in a different way, but it’s important to think about what your technology will allow you to do and what will work for your organisation.

Also, consider if what you are doing now is working and measure it. You can do this by analysing the number of complaints and satisfaction scores before and after you implement a policy and begin specialised training.”

Why Is Vulnerable Customer Training Necessary?

This kind of customer training is needed to best support customers who have difficulty making informed decisions because they are in vulnerable circumstances.

The vulnerable circumstance could be either permanent or temporary and it will likely relate to one of the following:

- Age

- Ill-health (both physical and mental)

- Infirmity

- Minority status

- Otherwise disempowered status in society

Each circumstance brings its own difficulties, as some can be particularly difficult to identify and each requires a different call-handling approach.

If the contact centre is not well prepared to handle calls from customers in each of these circumstances, you risk damaging your company’s reputation and, more importantly, harming the customer.

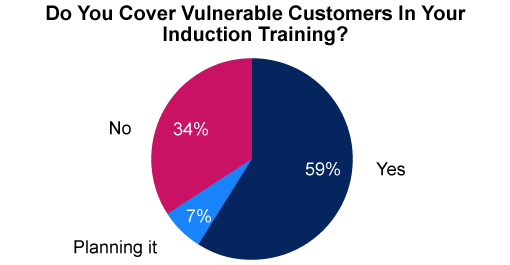

With this in mind, it was surprising to find that over a third of contact centres (34%) don’t even cover vulnerable customer training in their induction training, as highlighted in this chart.

If you don’t provide relevant training, your staff will not be equipped, will lack confidence and will feel unsupported when taking these challenging calls, damaging their morale, according to Jacqui Workman, Owner and Managing Director of KMB.

Jacqui says: “Sometimes there’s no policy in place for advisors to refer back to either, putting the advisor and organisation in a difficult position. Not having a policy or training will result in inconsistent service.”

The bottom line is that if you really care about your customers, you should be able to provide a consistent level of service to all of them and advisors need to feel supported in doing so.

Set Objectives for Vulnerable Customers

To ensure that your advisors are ready to handle contacts from vulnerable customers, make sure that your training allows the advisor meet each of the following objectives, as introduced by Jacqui Workman.

Appreciate that Vulnerability is Complex and Changeable

We want the team to understand the nature of each vulnerability and the challenges that they put upon the customer.

Have a Better Understanding to Help You Recognise Vulnerability

We want the team to identify vulnerable customers by understanding the signals they may receive from customers who have dementia, learning difficulties, been through bereavement, etc.

Develop Methods to Help Deal with Vulnerability

We want advisors to feel confident in how to proceed, once they have recognised that they are interacting with a vulnerable customer.

Create Confidence and Sensitivity Towards Vulnerability

We want advisors to be respectful of the customer’s condition and modify their service approach towards different vulnerabilities.

Assign a “Champion for Vulnerability” in the Organisation

We want one caring advisor to be our “champion for vulnerability” and to challenge our vulnerable customer policies and procedures, as well as develop training plans.

The Role of Technology

When handling vulnerable customer queries, it is important that advisors feel fully supported, as these can often be long and demanding contacts.

Here are two technologies that will help better support advisors while enhancing your vulnerable customer policy and procedures.

Speech Analytics

As speech analytics systems can provide detailed reports of all contact centre interactions, you can search the system to find examples of best and worst practice when handling difficult vulnerable customer calls.

Murphy

Mike Murphy, a Senior Account Executive at Genesys, says: “Bring these example recordings into training to help bring tricky vulnerable customer situations to life and ensure that advisors are fully engaged and are assured of what to do in these difficult situations.”

Contact centres can also use analytics reports to improve their vulnerable customer procedures by pinpointing approaches that advisors have taken that have been well received by customers.”

Predictive Routing

Over time, we pick up a lot of information about our advisors, including metric scores, skills, knowledge, their likes and dislikes, as well as their previous customers’ feedback and feedback from other members of the team.

On the other side, we also gather lots of information about our customers, including what they’ve purchased, their demographic and their individual likes and dislikes. All this information can be contained in individual customer profiles.

To make the most use of this data, Mike Murphy says: “Use predictive routing to make a best-informed decision of who the customer should be routed through to, as the technology compares customer and advisor information and predicts which customer–advisor combination will have the best outcome.

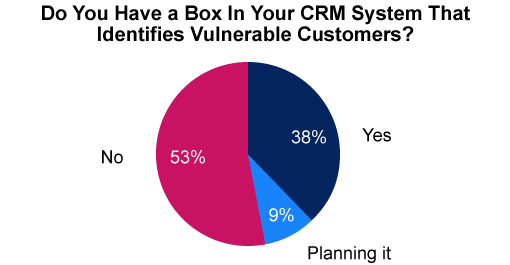

If your CRM system indicates that the customer is vulnerable, the technology can then pass the customer directly through to a specialist advisor, if you choose to create a team of advisors specialised in handling vulnerable customer contacts.”

To find out more about predictive routing, read our article: 3 Promising Contact Centre Technologies

To find out more on how best to handle tricky call types, read our articles:

- How to Write to Vulnerable Customers

- Dealing with Angry Customers

- A Policy for Dealing with Angry and Abusive Customers

Author: Guest Author

Reviewed by: Robyn Coppell

Published On: 16th Jan 2019 - Last modified: 4th Apr 2025

Read more about - Customer Service Strategy, Customer Service, Disability, Editor's Picks, Handling Customers, Health, Jacqui Workman, Mike Murphy, Vulnerable Customers