Frank Sherlock provides three emerging use cases that may help you to convert your contact centre into a predictions centre, for the whole business.

1. Use Artificial Intelligence (AI) and Machine Learning (ML) to discover trends

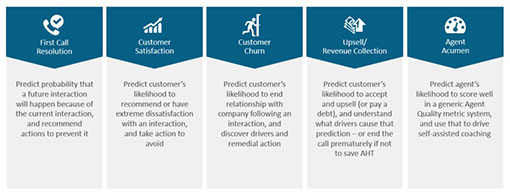

AI and ML can be used to accelerate the finding of ‘patterns’ in the huge volumes of data associated with customer interactions captured in the contact centre. You can use these ‘patterns’ for predictive scoring and discovery of key business insights.

Interaction analytics tools have the capacity to automate call categorisation and scoring. By adding AI and ML you will speed up the process of identifying patterns.

As a result, you will be able to:

- Predict outcomes to interactions, such as the potential for sales to close, or the likelihood of a customer deciding to switch to another supplier

- Discover trends that can have a big impact on your business productivity and performance. These include the causes of increases in call handle times, call volumes, customer dissatisfaction or repeat contacts, etc.

This kind of enriched insight presents great benefits for resource planning, sales and marketing campaign planning or manufacturing and service planning.

Also, it can help to drive sales and collections revenue. It can also protect customer subscription revenue, by identifying the likelihood of customer churn so you can prevent it from happening.

2. De-risk your business by predicting and detecting fraudulent transactions

Fraudsters are constantly developing new and innovative ways to commit fraud. So, relying on agents to recognise malicious attacks is a high-risk strategy. You will need to use technology to improve your defences.

Fraud analytics is a combination of speech analytics technology and voice biometrics that can be used to detect and predict the likely occurrence of fraud in contact centres.

Fraud analytics works because it can draw on insight created by analysing 100% of calls using interaction analytics.

As a result, it is possible to identify patterns of speech, behaviours, emotional acoustics and key words and phrases that are indicative of fraudulent behaviour. Voice biometrics are used to compare voices of customers with voices from identified fraudsters.

Fraud-specific tags are automatically applied to suspicious conversations thanks to language patterning capability. These interactions are then scored, tracked, and assessed based on the information provided by the interaction analytics software.

If a new incoming call is identified as likely to be fraudulent, the caller’s voice can be compared with voices of previously identified fraudsters, while the conversation’s transcript is used to spot the occurrence of the fraud-specific patterns of words or phrases.

This information is then passed to agents in the form of alerts to indicate that there is a high risk that they are dealing with a fraudulent caller. It can also be used for fraud-identification training and coaching purposes.

By implementing fraud analytics, contact centres can help prevent the business suffering significant reputational damage and financial losses.

Just as importantly, fraud analytics can help to protect customers’ personal data from fraudsters. With GDPR on the horizon, being able to protect personal data is now more important than ever.

3. Use real-time automated monitoring and alerting technology

When I talk to people about analytics they usually think I mean an activity that takes place after a call is over. So, while they accept that this post-call analysis can help to improve future agent behaviour, they don’t see it as something that can influence the outcome of a live call. This brings me to the next use of interaction analytics combined with AI and ML – real-time analytics.

Real-time analytics works by ‘streaming’ transcripts of conversations in real time. This enables key language patterns or acoustics that are present or missing to be identified so that if action is required, agents and supervisors can be provided with appropriate information in the form of alerts or next-best-action guidance.

Frank Sherlock

For example, agents who forget to read a specific part of the script that assures regulatory compliance would receive corrective guidance on their dashboard. Supervisors can also be alerted in real time to any calls that look like they are deteriorating so they can take the necessary action to achieve a successful call outcome.

This means that a bad call should be a thing of the past. Imagine the difference that would make to your call centre. Imagine the difference it will make to agent satisfaction because they know they will always have customers leave a call happy.

Author: Robyn Coppell

Published On: 24th May 2018 - Last modified: 18th Dec 2023

Read more about - Guest Blogs, CallMiner