As digital channels continue to dominate customer service, ensuring vulnerable customers receive the right support has become more important than ever.

That’s why Carolyn Blunt has shared her expert advice on how organizations can better support vulnerable customers in today’s increasingly digital environment.

Mental Health Takes Its Place on the Agenda

In recent years, mental health has finally taken its rightful place on organizational agendas, a shift unimaginable just a decade ago. This growing awareness is vital as we consider how best to support vulnerable customers in a digital world.

In recent years we have seen an increase in the regulatory pressures on topics such as fair treatment of vulnerable customers, but the firm placing of this topic on every organization’s agenda is also due to the awareness being raised on cyberbullying, problem debt and suicide.

These topics are finally being more openly talked about in schools, homes and workplaces by people from all walks of life.

Popular Culture Helps Break the Silence

We have seen a huge increase in the discussion of mental health – including Jesy Nelson from Little Mix on her BBC documentary ‘Odd One Out’ and online bullying.

We have been rocked by the suicide of the well-known TV star Caroline Flack in February 2020; and concerns for mental health and wellbeing have increased from the imposition of social distancing and self-isolation as a result of the global pandemic of COVID-19.

Defining Vulnerability in Customer Service

The Financial Conduct Authority (FCA) defines a vulnerable customer as “someone who, due to their personal circumstances, is especially susceptible to detriment – particularly when a firm is not acting with appropriate levels of care.”

Vulnerability covers many categories, from visible factors like age to less obvious ones like mental health struggles. However, many customers resist or don’t identify with the label “vulnerable”.

When using speech analytics, customers rarely self-identify as vulnerable. Instead, indicators appear in conversations through words like “accident”, “redundancy”, “bereavement”, or “financial problems”. These cues help organizations recognize customers who may need additional support.

Balancing Automation With Human Interaction

While automation offers efficiency and consistency in contact centres, it’s crucial to maintain the human element. Offering customers balanced choices of communication channels, whether digital or human-led, ensures that those needing extra care can access it.

In today’s evolving landscape, this balance has never been more important.

The Reality of Vulnerability – Key Statistics

In the UK, 5,656 people died by suicide in 2023, each one having a devastating effect on the family members, friends, colleagues and communities left behind – meaning most of us will be touched at some point if this hasn’t happened to you already.

- 1 in 20 adults in the UK report having suicidal thoughts – and those that do usually make an attempt on their own life within the first 12 months of such thoughts.

- 7 in 10 young people have experienced cyberbullying.

- 26% of young people who have been cyberbullied report feeling suicidal.

- In financial services call centres, one in four frontline staff spoke to at least one customer they believed might be at risk of suicide in the past year.

Yet many frontline employees report being “unclear how to respond”, “unaware of company policies”, and “untrained” to handle such situations.

Training to Support Vulnerable Customers

What training can organizations offer?

- Virtual or classroom sessions and digital learning modules can help staff understand vulnerability, recognize signs, sensitively question customers, and record their needs.

- Training should also cover how to respond appropriately, including offering additional services or referrals.

- If customer journeys have been heavily automated, consider reintroducing human support options and specialist teams trained in vulnerability.

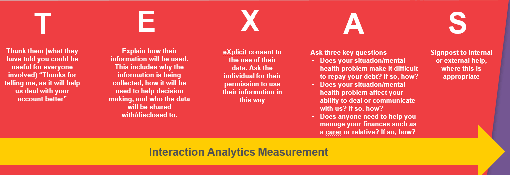

Using the TEXAS Model for Sensitive Conversations

The FCA recommends the TEXAS model, a five-step approach to engaging with vulnerable customers. This model helps frontline staff manage disclosures sensitively and effectively.

Incorporating TEXAS into training programmes and operational procedures can build confidence among staff and customers alike. Interaction analytics can be used to monitor adherence to the model and improve outcomes.

Questions for Benchmarking Your Current Approach

- Are you effectively identifying and supporting vulnerable customers?

- Have you trained your staff and introduced or revised processes for supporting vulnerable customers?

- Are you confident knowledge is being retained and used effectively?

- Have your compliance efforts shortened customer journeys or eliminated complexity?

- Are you supporting vulnerable employees as well as customers?

Supporting your agents with skills and resilience training, digital learning and knowledge retention, breaks after tough conversations and interaction analytics to find, coach and support through all mentions and triggers will ensure that vulnerable customers are supported in a digital world.

Written by: Carolyn Blunt

For more on supporting vulnerable customers, read these articles next:

- How to Deal With Vulnerable Customers

- How to Write to Vulnerable Customers

- How Signposting Helps Businesses to Support Vulnerable Customers

Author: Carolyn Blunt

Reviewed by: Hannah Swankie

Published On: 31st Jul 2025 - Last modified: 17th Nov 2025

Read more about - Expert Insights, Carolyn Blunt, Ember, Vulnerable Customers